richmond property tax inquiry

Richmond property tax inquiry. Richmond property tax inquiry.

About Your Tax Bill City Of Richmond Hill

To search for tax information you may search by the 10 digit parcel number last name of property owner or site address.

. Do not enter information in all the fields. Property tax bite. You must call the Treasurers Office to obtain the amount due.

Each office is reflective of the North Carolina General Statues that administers property taxation in North Carolina. When your neighbors are delinquent on property taxe. Why Richmond An Analysis of the Effects of Vehicle Property Taxes on Vehicle Demand Untitled Richmond considering new tax amnesty measures to help residents Richmond VA u003e Finance u003e Home Richmond Free.

815 am to 500 pm Monday to Friday. Ranking Cuyahoga County towns for bills on typical. Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered as being garaged in Richmond County as of January 1 st of each tax year.

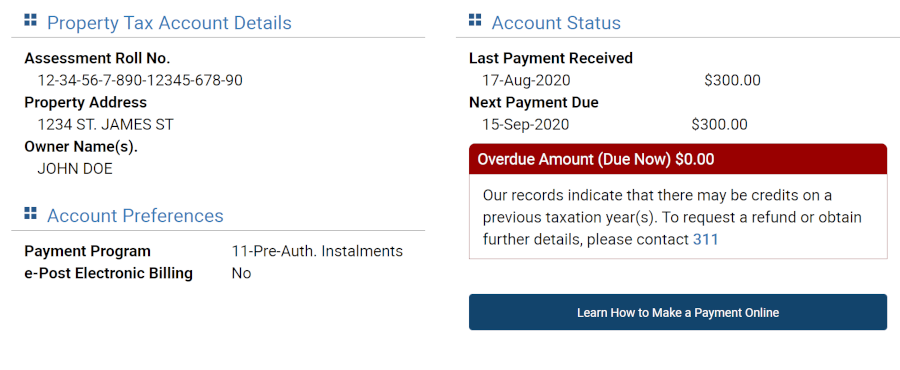

City of Richmond - My Property Account. Choose a search option from the first drop down box below and follow search instructions as noted. Personal Property Taxes are billed once a year with a December 5 th due date.

The Tax Administrator oversees the entire department to ensure that all tax law is being followed in. Understanding Your Tax Bill. City of Richmond BC Loss of farm status could see huge tax increases Richmond Free Press November 14 Richmond property taxes Richmond Free Press February 25 Richmond seniors and fixed ie earners are most affected by the.

Parking tickets can now be paid online. There is no convenience fee for eCheck payments. 3 Road Richmond British Columbia V6Y 2C1 Hours.

A convenience fee of 225 or a minimum fee of 100 for credit card and debit card payments will appear as a separate transaction on your credit card bill. City of Richmond 2019 and newer property taxes real estate and personal property are billed and collected by the Ray County Collector. Personal Property Registration Form An ANNUAL filing is required on all.

For commercial tenants wanting to change the mailing address of a utility bill contact the City of Richmond Tax Department at 604-276-4145 or TaxDeptrichmondca. To pay your 2019 or newer property taxes online visit the Ray County Collectors website. Property values are determined by the City Assessor and the Department of Finance issues the tax bills based on the valuation information provided by the Assessors Office.

Some customers have experienced their browsers stall when being redirected from the selection of their property accounts to the payment website. Your annual property taxes collected by the City of Richmond funds municipal services and other taxing agencies such as the Province of BC School Tax TransLink BC Assessment Authority Metro Vancouver and the Municipal Finance Authority. If you do not have an account click here to.

Call 804 646-7000 or send an email to the Department of Finance. 3 Road Richmond British Columbia V6Y 2C1. Click Here to Pay Parking Ticket Online.

My Property Account is an online profile that gives you secure access to information regarding your City of Richmond accounts such as Utility Billing Dog Licences and Property Taxes - 24 hours a day 7 days a week. The City of Richmond is authorized by state law to levy taxes on real property in the city of Richmond. Real Estate Property Cards.

For any questions or inquiries about your property tax rate or property tax bill you can reach out to the city of Richmonds property tax department through. Education and Human Services Committee Meeting - April 14 2022 at 200 pm. Real Estate and Personal Property Taxes Online Payment.

City of Richmond Property Search. Land Use Housing and Transportation Committee Meeting on April 19 2022 at 130 pm. The fee will appear as a charge from Fort Bend County - GovPay Fee.

Allow 6 to 8 weeks for processing. Finance Taxes Budgets. Parking Violations Online Payment.

FIND ONLINE ASSESSMENT AND PROPERTY CARD INFORMATION HERE. The Richmond County Tax Department consists of three departments that are responsible for providing customer service to the tax payers of Richmond County. When searching choose only one of the listed criteria.

Disabled Veterans or their surviving spouses who believe they may be eligible for the real estate tax. Partial Parcel ID may be entered but at least 8 digits should be entered in order to activate. Demystifying Property Tax Apportionment httpstaxcolpcocontra-costacaustaxpaymentrev3summaryaccount_lookupjsp.

LAST UPDATED NOVEMBER 30 2018 USING 2017 DEED TRANSFERS. In case of an emergency call the City of Richmond 24 Hour Call Centre at 604-244-1262. Search by Parcel IDMap Reference Number.

All City of Richmond delinquent taxes 2018 and prior must be paid to the City of Richmond Collector prior to paying 2019 or newer property taxes to the. The propertys Parcel ID should be entered such as W0210213002. Only the registered property owner is allowed to change the mailing address.

Property Information Search Portal. Effective date of last General Reassessment. These agencies provide their required tax rates and the City collects the taxes on their behalf.

For Real Estate Tax Payments you will need your 5 digit Account Number and your Bill Number. For Personal Property Tax Payments you will need your 5 Digit Account Number. Use this form to report non-emergency concerns regarding your property services and utilities or problems in your neighbourhood like street lights out or pot holes.

Please feel free to call us at 281-341-3710 or email us at FBCTaxInfofortbendcountytxgov with any auto or property tax questions. Richmond County currently performs a General Reassessment every four 4 to five 5 years. Manage Your Tax Account.

Welcome to the My Property Account online access for the City of Richmond. Due Dates and Penalties for Property Tax. Search by Parcel ID Search by Property Address Search by Other Information.

Report a Problem Request a Service. Press 3 for property tax and all other payments Enter Jurisdiction Code 9010. CONTACT THE TAX OFFICE VIA PHONE OR EMAIL.

McHenry County Property Tax Inquiry. Pay Your Parking Violation. City Offices Closed April 15 in observance of the Spring Holiday.

Richmond Hill Property Tax 2021 Calculator Rates Wowa Ca

Toronto Property Tax 2021 Calculator Rates Wowa Ca

Richmond Property Tax 2021 Calculator Rates Wowa Ca

Municipal Property Assessment Mpac City Of Richmond Hill

About Your Tax Bill City Of Richmond Hill

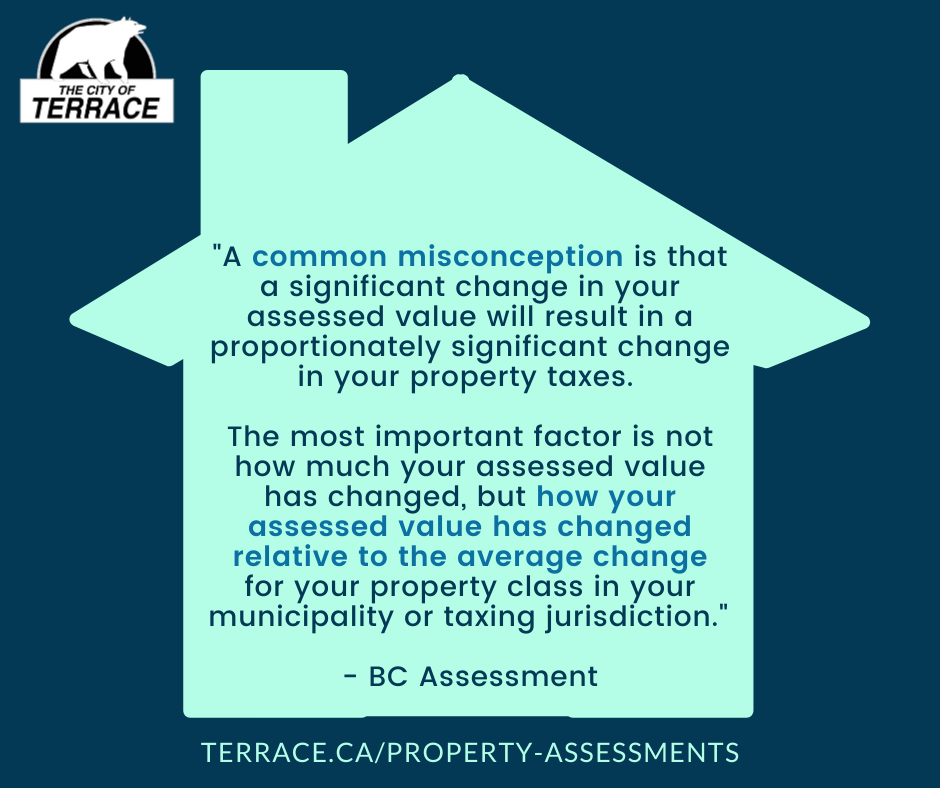

Property Assessments City Of Terrace

802 W 28th St Richmond Va 23225 Realtor Com

Residential Property Tax Calculator

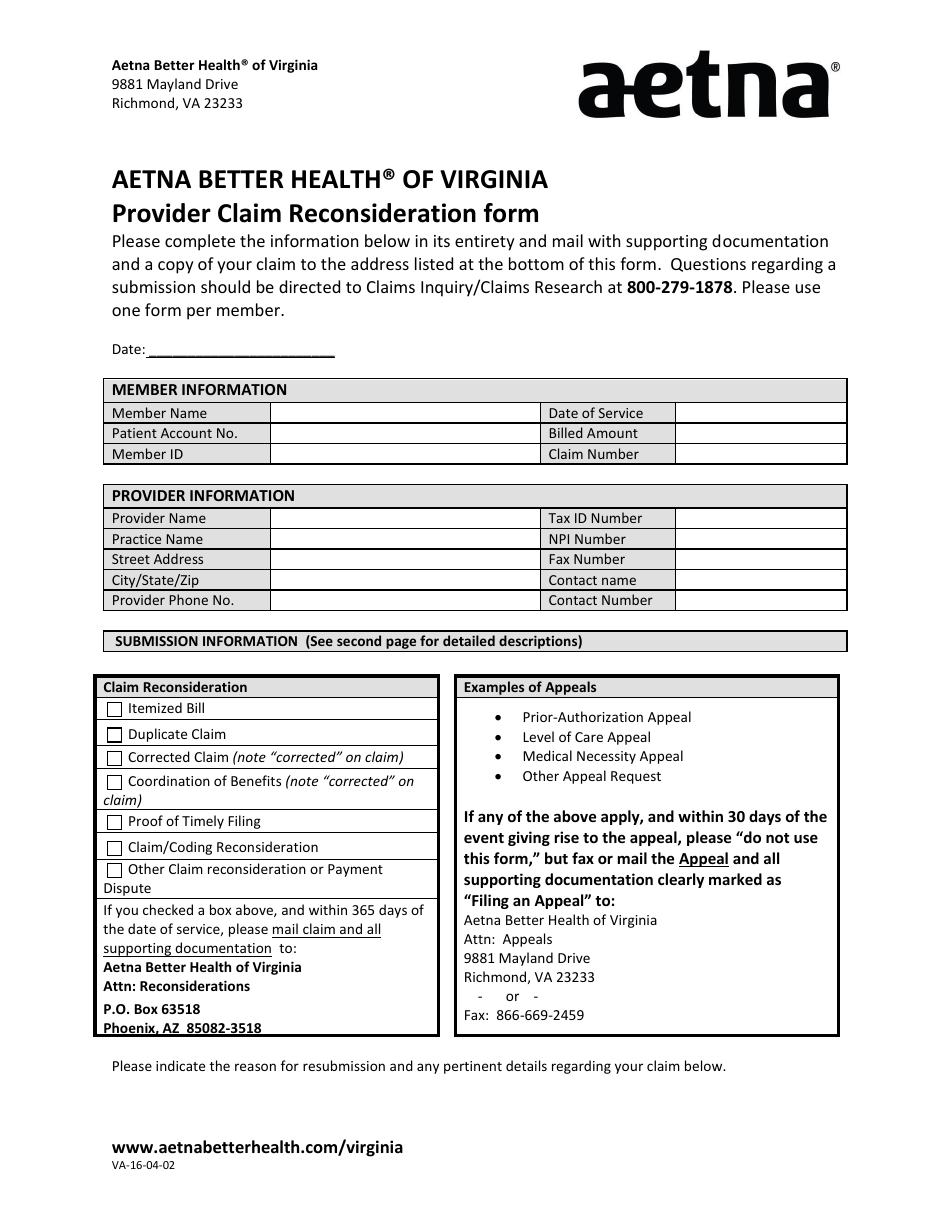

Form Va 16 04 02 Download Printable Pdf Or Fill Online Provider Claim Reconsideration Aetna Virginia Templateroller

City Of Richmond Hill E Newsletter City Of Richmond Hill

About Your Tax Bill City Of Richmond Hill

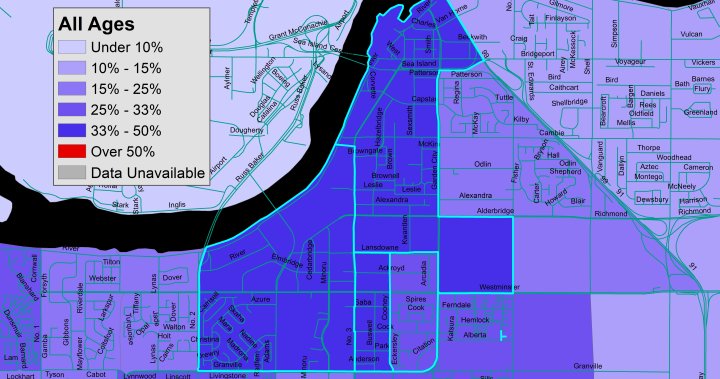

Richmond Downtown Eastside Have Similar Levels Of Low Income Working Aged People Study Bc Globalnews Ca

The Next Big Thing Richmond Free Press Serving The African American Community In Richmond Va