florida estate tax limit

If you own a house in Florida as your permanent residence you may be entitled to a property tax exemption known as a homestead exemption of up to 50000. Property Tax in Florida.

Some States recognize both the Small Estate affidavit and Summary Administration basing the requirement of which one to use on the value of the estate.

. Estate in Florida with a just value less than 250000 as determined in the first tax year that the owner applies and is eligible for the exemption and who has maintained permanent residence on the property for at least 25 years is 65 or older and whose household income does not exceed the household income. Per Florida Statute 1931556 any person or entity owning property under the 10 cap provision MUST notify the property appraiser promptly of any change of ownership or control. The estate tax is a tax on an individuals right to transfer property upon your death.

The non-homestead cap lets owners of second homes vacation homes and commercial properties such as rentals and vacant land limit their annual property tax to ten percent including school board assessments. If the estate value is 10000 or less an affidavit is allowed but if the value is between 10000 to 20000 a summary administration is allowed. The first 25000 applies to all property taxes including school district taxes.

And to find the amount due the fair market values of all the decedents assets as of death are added up. The Executor must file a federal estate tax return within 9 months and pay 40 percent of any assets over that threshold. Additionally it called for providing a 25000 exemption for people who had not owned a.

Florida estate tax limit. Florida DOR caps assessed value of Homestead properties at 14 percent. Proper estate planning can lower the value of an estate such that no or minimal taxes are owed.

Even though Florida doesnt have an estate tax you might still owe. In 2022 the estate tax threshold for federal estate tax is 11 million and seven hundred thousand dollars 1170000000 meaning that if a decedent has less than 11 million and seven hundred thousand dollars in assets there will be no estate tax. 2 Enforce child support law on behalf of about 1025000 children with 126 billion collected in FY 0607.

The estate of a deceased person in Florida could still owe federal inheritance taxes if the value of estate is over the lifetime limit 11700000 in 2021. The local property appraiser sets the assessed value to each property effective January 1st each year. The assessed value of the property.

Florida does not have an estate tax or income tax so the only taxes that can apply to a Florida estate are federal taxes. Florida does not have a state income tax. 1 Administer tax law for 36 taxes and fees processing nearly 375 billion and more than 10 million tax filings annually.

But if you transfer an estate valued at something higher than that upon death the federal government can tax a portion of the estate you leave behind before its transferred to the designated heirs. As noted above the federal estate tax rate can climb to 40 depending on the size of your taxable estate. The decedent must have been dead for more than 2 years.

In september the state also increased its progressive estate tax rate to as high as 20 for estates valued at. If an estate is worth 15 million 36 million is taxed at 40 percent. No estate tax or inheritance tax.

The additional exemption up to 25000 applies to the assessed value. This year the maximum increase on the assessed value of a Homestead property in. Owns real estate with a just value less than 250000 Has made it his or her permanent residence for at least 25 years Is age 65 or older Does not have a household income that.

The exemption increased after the new tax legislation was signed in 2017. Florida law limits annual increases in property value assessments on real property qualifying for and receiving a homestead exemption. 13 rows Federal Estate Tax.

In addition the state doesnt. The 2021 tax year limit or the amount limit in 2022 after adjusting for inflation is 1206 million up from 117 million in 2021. 1 Any funds after that will be taxed as they pass.

TAMPA -- The 2022 limit for assessment value increases of Homestead property has been released by the Florida Department of Revenue FDOR. Failure to do so may subject the property owner to a lien of back taxes plus interest of 15 per annum and a penalty of 50 of the taxes avoided. Property taxes fund public schools libraries medical services infrastructure and roads.

The Save Our Homes property tax cap is an amendment to the Florida constitution that limits the annual increase in the tax assessment of homestead property to a maximum of 3 of the prior years assessment. There is no inheritance tax or estate tax in Florida. A person may be eligible for this exemption if he or she meets the following requirements.

The value of the estate must be equal to or less than 75000 or. A Florida Property Tax Limit Amendment 3 initiative did not appear on the November 2 2010 ballot as a legislatively referred constitutional amendment. As of 2019 if a person who dies leaves behind an estate that exceeds 114 million.

The Homestead Exemption limits to 3 the annual increase of the propertys assessed value from the prior year. Florida Department of Revenue - The Florida Department of Revenue has three primary lines of business. And its purpose is to encourage the preservation of homestead property and to ensure that Floridians will not lose their homes on the tax block because of.

Luckily there is no Florida estate tax. 3 Oversee property tax. The proposal called for limiting the maximum annual increase in the assessed values of nonhomestead property to 5.

Florida Inheritance Tax Beginner S Guide Alper Law

![]()

Florida Inheritance Tax Beginner S Guide Alper Law

Florida Inheritance Tax Beginner S Guide Alper Law

How Your Estate Is Taxed Or Not

Ultra Rich Skip Estate Tax And Spark A 50 Collapse In Irs Revenue Bloomberg

Uk And Ireland Impose Highest Taxes On Inheritance Of All Major Economies Uhy Internationaluhy International

Florida Property Tax H R Block

Eight Things You Need To Know About The Death Tax Before You Die

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

States With No Estate Tax Or Inheritance Tax Plan Where You Die

What You Need To Know About Estate Tax In Florida St Petersburg Estate Planning Lawyers

Florida Income Tax Calculator Smartasset

Florida Attorney For Federal Estate Taxes Karp Law Firm

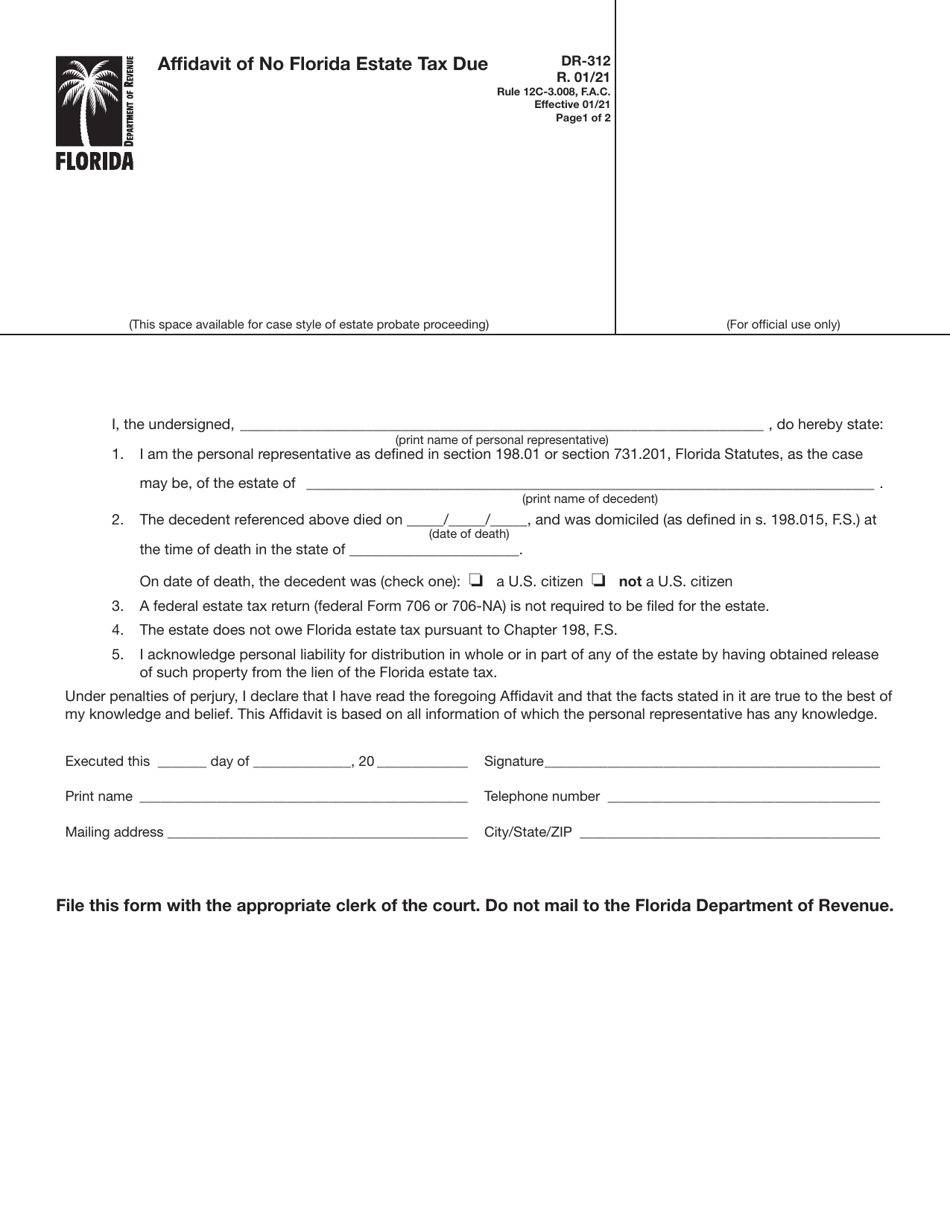

Form Dr 312 Download Printable Pdf Or Fill Online Affidavit Of No Florida Estate Tax Due Florida Templateroller

Ultra Rich Skip Estate Tax And Spark A 50 Collapse In Irs Revenue Bloomberg

Florida Homestead Exemption How It Works Kin Insurance

Form Dr 312 Download Printable Pdf Or Fill Online Affidavit Of No Florida Estate Tax Due Florida Templateroller